Summary:

- My career as a penny-stock equity analyst gives a unique perspective to the issuer

- HMNY is insolvent and the likelihood of bankruptcy is very high

- Management never cared about a viable business model

- Even today’s kinder, gentler SEC is likely to investigate the company

- It’s almost certain shares will be delisted from NASDAQ

- HMNY has several corporate attributes of a penny-stock company, and may be a "pump & dump" scheme

I did it, I did it, Oh My:

I remember one of my first

jobs out of college. It was as a

small-cap equity analyst. This was the

holy grail for me since childhood. Most

kids played sports during their leisure time, but I read stock charts like an

astrologist reads the night sky.

My supervisor was a certified

financial analyst and I quickly took to the mentor-mentee relationship. However, the bromance ended quickly. I slowly learned, through circumstantial

evidence and mystery envelopes found on my desk, that my employer was a pump

& dump broker. Back then, they were

called boiler rooms – go see the movie.

As I slowly peeled that onion, I eventually realized that my employer

was rotten at its core.

My employer’s modus operandi was

selling shares of “story stocks” to innocent investors. Think of your sweet grandma and frail granddaddy

– they were the “total addressable market” for selling penny shares to. The shares typically rose initially, which

brought in even more investors that had FOMO (fears of missing out). After 6 months, the shares then plummeted,

typically declining over 90%. When

investors called to sell, the brokers’ lines suddenly went silent.

There are several ways boiler

rooms profit from penny stocks including brokerage fees, etc. but the largest method

is by having “relationship entities” and/or insiders owning a large proportion

of the company. Their shares are then

sold during an IPO or run-up in shares of already public companies.

My friends, Helios and Matheson Analytics (HMNY) reminds

me of those days though the company may not be part of a calculated pump &

dump scheme. As a reminder, HMNY is the 92%

owner of MoviePass, having initially invested $27MM in August 2017 (for a total

sum of $72MM as of Dec 2017). I was

introduced to MoviePass last fall when my sister-in-law ranted & raved that

it was the greatest thing since sliced bread (just $10/month). My dollar-wise wife surprised me by purchasing

an annual contract, which further reduced the cost to $7/month.

I recently pored through

several critical Seeking Alpha articles; most authors have calculated how unprofitable the

business model is. It usually goes

something like this: HMNY pays full

price for tickets but its MoviePass customers (depending on how many times they

go to the theater) pay less, so HMNY is losing money. My response to you is – not all management is

stupid. HMNY’s management team can

clearly see that losses are rising as subscribers grow. If the business model made them the next

Netflix, so be it. But that may not have

been their intention. Management and

insiders benefited when their shares (received through stock awards) rose or

from company fees given to them. The

Netflix shtick was the story that MoviePass

CEO Mitch Lowe was hoping could elevate HMNY’s share price.

Insider

Muralikrishna Gadiyaram, for

example, received shares which he later sold at a lofty $13/share (pre-reverse

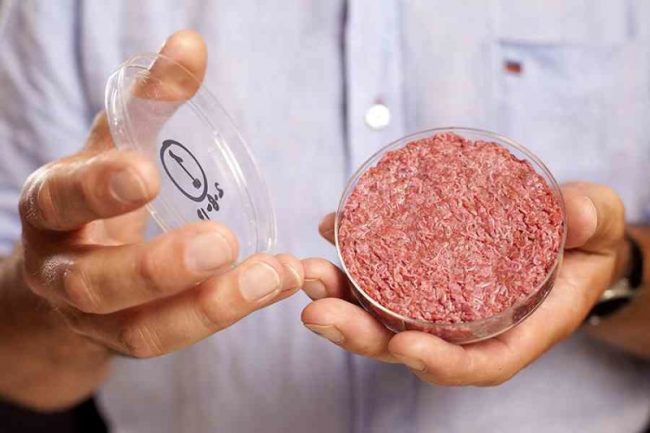

split) on November 2017 according to SEC Form 4. The stock chart below is for the 1YR time

period of May 2017 and May 2018 (post reverse-split prices). The history of his beneficial ownership of

HMNY can be found here. Gadiyaram also receives consulting fees on an

ongoing basis, according to Item 13 and Note 18 of the recent Annual Report.

HMNY Share Price (5/17 - 5/18)

Penny stock attributes:

Penny stocks (which are

sometimes manipulated) tend to be extremely small, with Revenues under $100MM,

have had corporate name changes, are controlled by dubious insiders, file late (or

amend forms) with the SEC (Securities & Exchange Commission), conduct

transactions with related entities, have had a reverse merger or corporate

structure changes, are not audited by the Big 4, have misleading statements, and

have weak accounting quality and governance (AGR). While HMNY may not be part of a calculated scheme, note that the company has some

of those attributes. Examples of these characteristics

are listed below:

a)

Small Size: HMNY’s revenues were just $10.4MM in FY’17,

according to the Annual Report.

b)

Name changes: There have been several name

changes of related entities. Helios and

Matheson Analytics (aka “HMNY”), the subject of this article, was originally

called “A Consulting Team” (and publicly traded on the NASDAQ). It changed its name to

Helios and Matheson North America in 2007.

Its name was changed to

Helios and Matheson Technology Inc. in 2011.

In 2013, it changed its

name to the current Helios and Matheson Analytics. Note that during 2011 and 2012, the company’s

name was identical to that of its Indian parent – Helios and Matheson

Technology Inc. (HMIT) Confused?

c)

HMNY is controlled by dubious insiders: Its parent

company, HMIT controlled approximately 75% of HMNY until November 2016 when

HMNY merged with Zone Technologies (controlled by then CEO Ted

Farnsworth). After the merger,

Farnsworth and HMIT owned 59% of HMNY. According

to Bloomberg,

Farnsworth was involved with penny stocks – three companies he led had shares

decline 99% despite his (overly) ambitious plans.

a. MoviePass CEO

Mitch Lowe also has penny-stock experience as a director of Medbox, which was sued for

fraud by the SEC in 2016. There is also

a controversy of whether Lowe overstated his experience as a “cofounder” of

Netflix according to The Street Sweeper. I examined Netflix’s initial

Form S-1 filed on April 2000 (really bad timing!) and while Lowe is not listed

as one of the two cofounders, he was an executive at the company.

b. HMNY insider

Muralikrishna Gadiyaram (cofounder of HMIT), received a liquidation order by a

court of India resulting from creditors’ claims against HMIT which is being

accused of fraud.

c. HMNY’s former chief

technology officer, Parthasarathy Krishnan (who received large stock awards)

was also an executive of HMIT and is also on the receiving end of the Indian court order according to Business Insider.

d. Lastly, note that

HMIT holds a $2MM security deposit for unused

services to HMNY, of which it’s likely not to receive given the court order

(source 10-k).

d)

Late filings: HMNY filed its Form 10-K for

2017 late. The 10-K for 2015 was amended

to note that the proxy statement would be filed late.

e)

Transactions with related entities: As already

mentioned, HMNY has conducted transactions with HMIT including consulting and

other fees to controlling shareholders of HMIT.

f)

Corporate structure changes: There have

been many changes within and between HMNY and HMIT including the shift in

control of HMNY (and MoviePass) from HMIT to HMNY. One wonders what the courts allow in India –

there must be some version of fraudulent conveyance? In addition, Zone

Technology, a private company acquired by HMNY, announced on March 2018 that it

would be spun-off into a publicly traded entity (but with what assets?!)

g)

Misleading statements:. HMNY’s CEO Ted

Farnsworth stated to Variety

magazine during a May 2018 interview at Cannes that the company has an equity

line of credit, alluding to what is more commonly called a committed Revolver. That is untrue, as I have not seen evidence

in the quarterly or annual reports

sent to the SEC. The SEC requires that

all forms of liquidity, including both internal and external, be

disclosed. The SEC rule can be found here. Farnsworth

is also on the record saying that HMNY would be worth $1 billion once it

reaches 2.5 million subscribers. As of

this writing, Moviepass has over 3 million subs and its market cap is under $1

million. On April 2018, HMNY said it

would get into the film studio business and acquired a stake in the John Gotti film (awful movie by the way). Besides lacking the funding to get into the

craft of making films, the business rational was that MoviePass can “guarantee

box office attendance”- Really?!

h)

Weak accounting and governance (AGR):.. HMNY’s very own annual report for 2017 states that

“Management has determined that the Company did not maintain effective internal

control over financial reporting as of the period ended December 31, 2017 due

to the existence of the following material weakness identified by management:

Lack of Accounting Resources.” Further,

the AGR research firm MSCI GMI Analyst rates the company “1”, its worst score. HMNY is not audited by a Big 4 accounting

firm. Its auditor is Rosenberg Rich

Baker Berman, P.A.

Investors should avoid HMNY

shares like a bad movie. The company

recently took out a payday-like loan ($5 million) from a hedge fund that was

repaid on August 5th 2018. The

loan was necessary to “keep the lights on” as one would say. The company also has a $1.2Bn shelf offering

filed with the SEC. While this article

is not focused on HMNY’s accounting, do note that HMNY is bleeding cash. The company has just $14MM in

unrestricted cash and reports $42.5MM on its balance sheet as of March 2018

(see table).

Total Liabilities are greater

than Total Assets which classifies the company as insolvent according to IRS rules. It is just a matter of time before the

company files for bankruptcy given that it is insolvent and has a$68MM operating

cash flow deficit. The $22MM/month

deficit is greater than the $14MM in unrestricted cash. Management and its independent auditors said

there is “substantial doubt” the company can continue in its recent Annual Report. Management is actively changing its subscription

model (see next section) however, a turnaround appears to be a long-shot.

The constantly changing subscription model is

confusing customers

July 31, 2018, HMNY said it

would boost prices by about 50% so a membership would now cost $15/month,

black-out first-run movies for the first two weeks of their release, continue

charging “peak pricing”, make customers take photos of their tickets and

additional tactics to improve cash flow.

Just a week later, on August 6, 2018, the company changed its MoviePass

pricing plan again saying it would now offer a monthly subscription of $9.95

and suspend peak pricing, ticket verification.

It essentially reversed its July 31st announcement but now

limits movies to just three month.

I believe the above changes

in the MoviePass plan creates confusion and uncertainty among customers which

will lead to higher churn and loss of goodwill.

In September 2011, Netflix changed its subscription plan, losing 800,000 customers in the process. My wife, for example, has

already switched to AMC’s competing plan, and while more expensive, there’s a

peace to certainty.

Under current listing rules,

it is doubtful HMNY shares can stay on the NASDAQ given that they don’t fulfill

most, if not all of the listing requirements including the minimum share price and $45MM market capitalization of

public securities. As of this writing

HMNY’s market capitalization was under $1MM.

Conclusion:

The point of this article

wasn’t to debate HMNY’s business model or do a forensic accounting of financial

shenanigans. Given my background in

penny stocks, I wanted to show you how to avoid shoddy investments by using a

qualitative common sense approach. Even

if life-saving financing miraculously appears, an SEC investigation will likely

ensue given the company’s shady history and misleading statements. Why bother with such nonsense when they’re

many good fish in the Sea ?

Special Disclaimer:

The approach above was

created using the Mosaic Theory, as postulated by the CFA Institute. It is a method of analysis used by stock

analysts to gather information about a corporation. It involves collecting public, non-public and

non-material information about a company to determine the underlying value of

its securities and to enable the analyst to make recommendations to clients

based on that information (source: Investopedia).